In today’s world, the importance of a bank account that is capable of receiving foreign currency cannot be overemphasized. Reason being that, people make a living on the Internet these days and as such, having an account that can conveniently be used to receive payments from international firms is much needed. Cleva application happens to be one of the indigenous platforms that provides users with foreign bank accounts for receiving dollars.

Key Takeaways

- Cleva is a mobile application that allows users create US Dollar bank accounts easily without having to complete much requirements or pass through any rigorous process.

- The application is safe and duly authorized by the FinCEN to operate in the United States and other financial bodies in Nigeria.

- It has some very nice features such as the option to transfer money directly to local naira bank accounts, option to create a virtual card and some downsides or areas that may not appeal to many such as, the absence of live chat support and frequent app updates.

Cleva was recently launched in Nigeria and ever since they’ve recorded significant growth, boasting of over 50,000 users so far in Nigeria. If you are looking for an application that can render foreign account opening service then you might be in luck. In this article, we will be reviewing Cleva app, how it works, how to get started and finally, the upsides and the downsides for people who may want to make it their primary means of receiving and saving money in foreign currency.

About

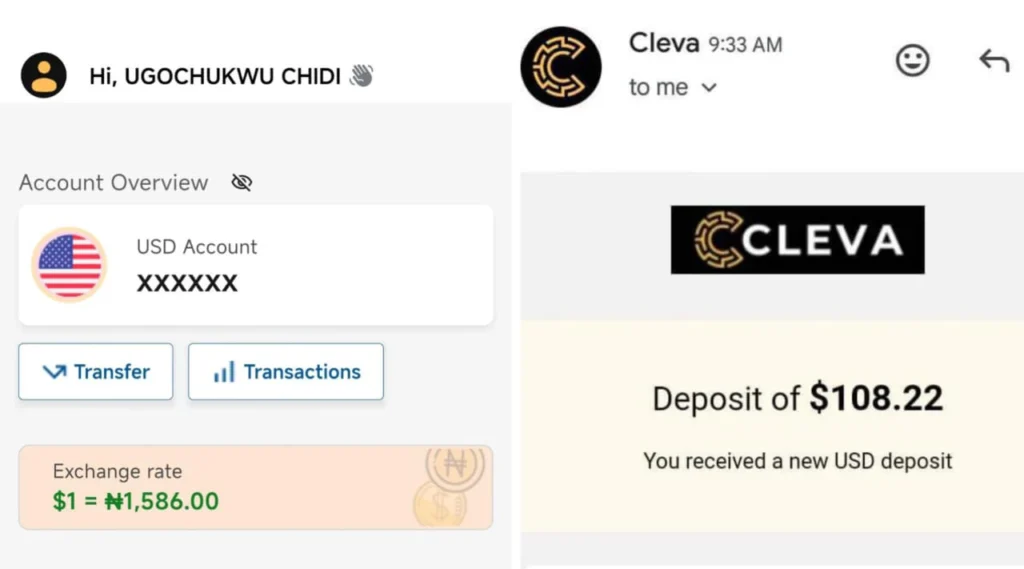

Cleva bank or Get cleva is a mobile application that is both available on Android and iOS that provides users with a US Bank account for receiving dollars as well as provide them a convenient way to convert the received dollars to local currency. So the application not only serves as a bank for just receiving dollars but also has a channel through which, users can convert their money to local currency and withdraw directly to their bank accounts.

Like I said earlier, the mobile application was launched towards the end of last year and ever since, they have recorded significant growth evident from the number of downloads they have on play store.

At first, it started off as a website before the development of their mobile application which is now conveniently accessible to every user and intending user.

Getting Started

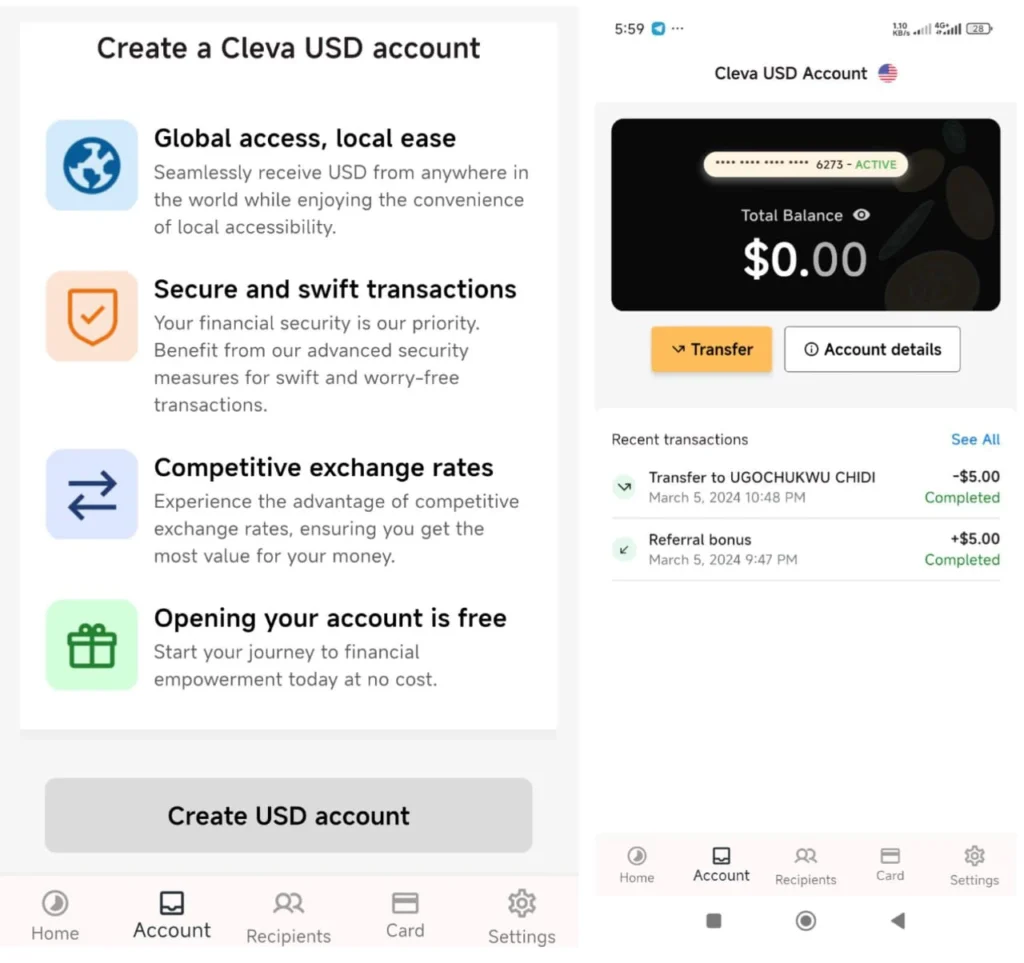

To create an account on cleva, the first step is to download the mobile application from play store as that is the first step you have to take in order to get a dollar account for your payments.

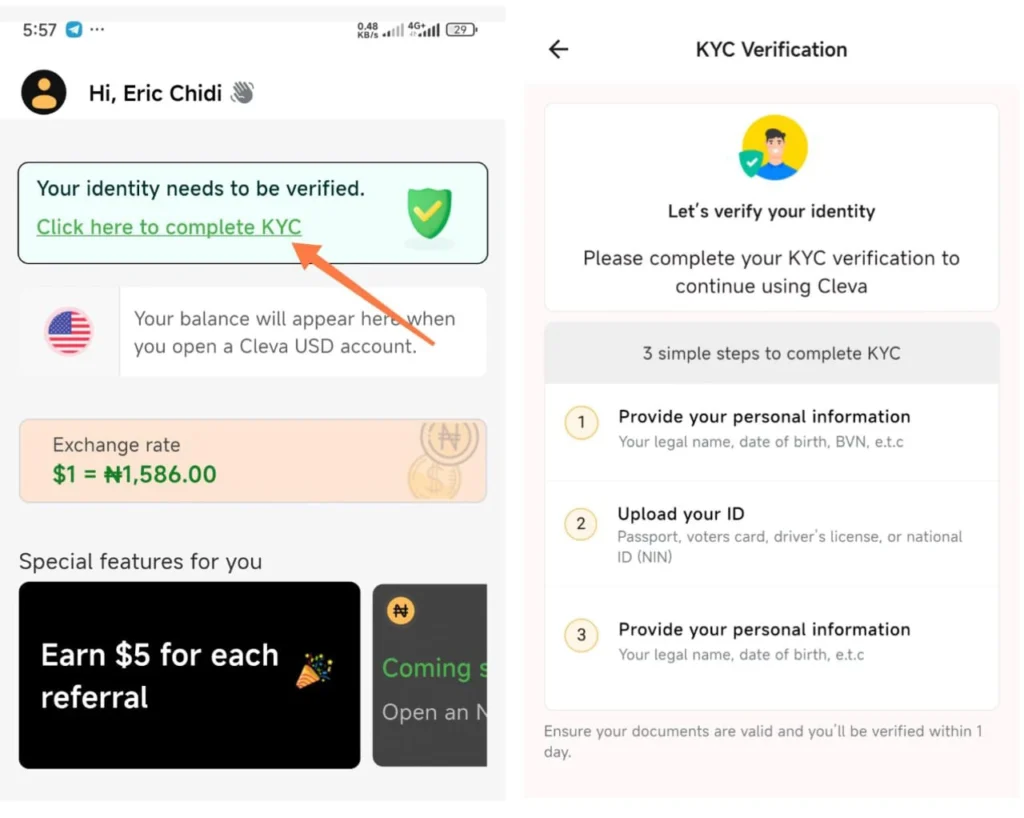

After downloading the app, proceed to the sign up page or create account option. Fill the form with your real details; use this code – UGOC568 as referral code if you’re finding out about cleva from this article.

As we all know, KYC is compulsory for all financial institutions and brands. So upon completion of the sign up process, you’d have to verify your account with either NIN or any government issued ID before you will be allowed to set up a bank account

Simply get your BVN and NIN preferably, use them to verify your account and then, click on Account, proceed to create a USD account. It takes a couple of minutes for the account to be generated and your details will be revealed to you.

Immediately the account is created, you can copy the necessary details and fill it into any organization or firm you intend receiving money from.

How to Convert USD to Naira on Cleva

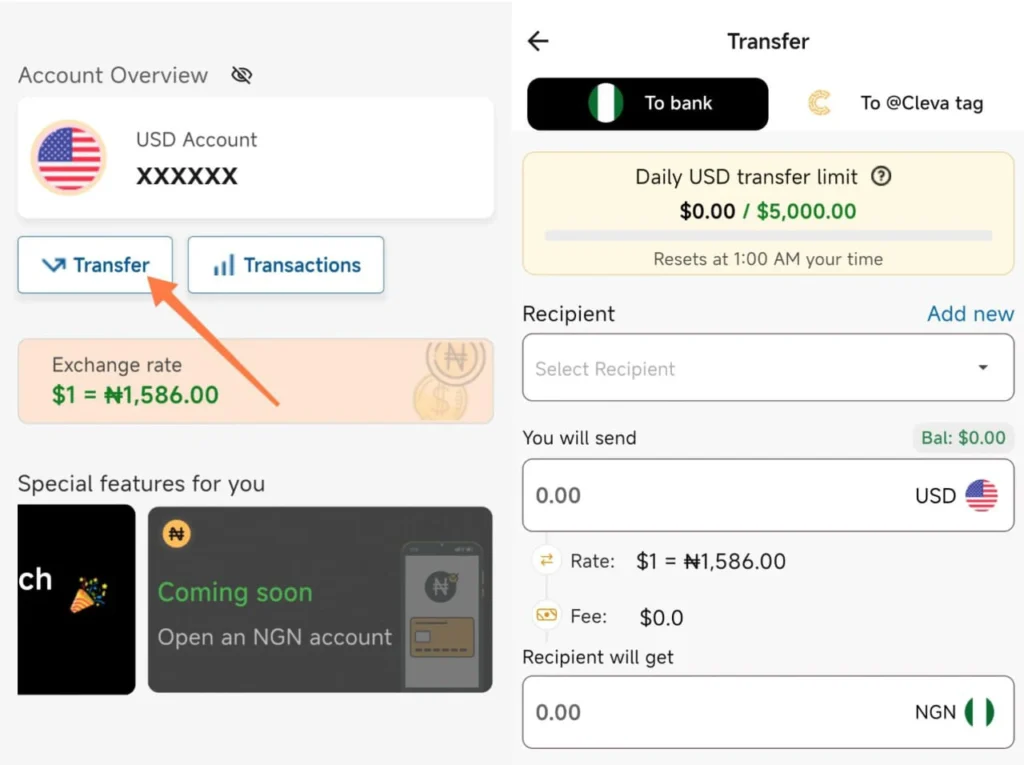

This is one of the interesting features on cleva that you won’t get on other apps easily. You can convert from USD to Naira easily. Once you receive the money, click on Accounts > Transfer, you will be shown two options.

Option to Transfer the money to local bank account and option to transfer to another cleva user via the tag. Proceed to fill the bank account you wish to withdraw your dollars to and enter amount.

The rate is usually the black market rate, so you will most likely have no issues with discrepancies between official and black market rate. Enter the amount and tap on continue to complete the transaction.

Wait for a couple of minutes for the naira equivalent of the dollar withdrawn to be credited to your bank account. From my experience, it takes less than 5 minutes though, it’s largely dependent on the receiving bank. If you make use of one of these fintechs, it should arrive in a couple of minutes.

Verdict

When it comes to the issue of legitimacy, cleva App is legit and safe to use. Now this is not just coming from a place of assumption, they are duly approved by the FinCEN (Financial Crimes Enforcement Network) in the United States which gives them the full license to operate.

Therefore, there is no risk associated with receiving your dollar payments using the bank account provided to you by cleva. You can also save the money as you want when received.

The most noticeable downside for me personally, is the fact that, they don’t provide users with a local bank account, meaning that, there’s no way to deposit money into your USD account externally. We are hoping that this will be added in future updates, but for now, you can only use the USD account to receive money from firms and international organizations.

As a freelancer who gets paid in foreign currency, you should have no issues making use of the account.

Benefits Of Using Cleva App

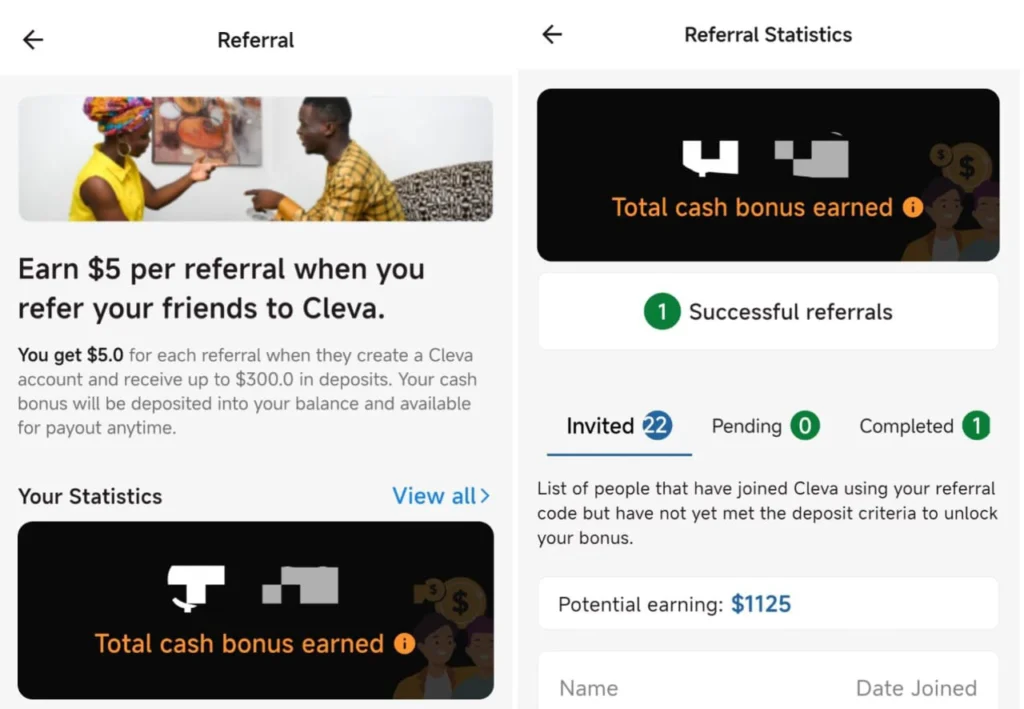

1. Enticing referral program – whether you are just on the app to receive foreign currency or you know alot of people who may be in need of the services they have to offer, cleva has got you covered. As a user, of you are able to get people to sign up and use the dollar account to receive up to $300, you’d be given $5 bonus and this is unlimited. Meaning you can earn as much as possible depending on the number of active referrals you have.

2. Simple User interface – the UI is simple and creation of bank account is very easy. You don’t need to have much tech knowledge to open a dollar account on cleva and this i must confess, is a plus for everyone including the platform.

3. Virtual Card Services – you can create a dollar virtual card on cleva. Though it’s kind of limited since there is no way to fund wallet externally for the purpose of creating a card, it’s still good to know that, people who constantly use the bank accounts provided by cleva can easily create a virtual card alongside for just $3 fee which includes $1 starting balance.

Most general aspects of cleva are cool, but like I said, there are some downsides and upsides. Having discussed some of the upsides already, let’s look at some areas, I feel cleva should improve and some of these areas would probably matter to you as well as a user;

1. Frequent Application Updates – this is one area I find really annoying. If you are a regular user of cleva App, you will find out that the app gets a new update too frequently. I mean, it’s normal for new updates to be released from time to time, but when it gets too frequent, it can be a pain in the ass. Sometimes the cleva App gets an update twice in a week or even more, making users spend much on data just to keep the app up-to-date.

Also Read: Gift Sun App Review: Is It Really Paying? (How it Works)

This is one area that should be worked on seriously, they should work on major updates and churn them out at once, instead of the regular, little updates that take a toll on one’s data subscription.

2. Absence of a Live Chat Support – support is pertinent when dealing with things related to money. When I signed up on cleva last year, they had no mobile application, no live chat support and no option to create a virtual dollar card but I didn’t take those too seriously because it’d just started. But it’s been nearly a year since they launched and improvements have been made but still no live chat support.

The only way to contact them is by sending a mail to their support emails; though the support team is active, I still feel there is need for an improvement in that aspect because people tend to lose interest when their problems can’t just be addressed easily by messaging the support representatives on the app. A live chat support is needed; I hope it gets added in the near future.

3. Absence of a local bank account – there should be a local bank account available on the app to enable users fund their wallets externally in order for them to activate the virtual card. At the moment, it’s impossible to fund the dollar account externally apart from using it to receive payments, so creating a virtual card is impossible unless you received money from firms or organizations and then use a part of the received funds to create a virtual card.

According to the information on the app, Naira bank account will soon be available, we hope it gets added soon as that would make the app even more flexible.

Conclusion

Cleva app is legit and safe to use as it’s duly authorized by all bodies. If you are a freelancer looking for a simple to use platform or mobile app that provides dollar bank accounts, then this is certainly worth considering. Having examined the upsides and downsides, there is no denying the fact that cleva still offers top tier service that can’t be easily found elsewhere.

Thanks, share and do well to join our telegram channel for more updates.

Join Our WhatsApp Channel